TORONTO – January 16, 2025: Urbanation Inc., the leading source of information and analysis on the condominium market since 1981, released its year-end 2024 Condominium Market Survey results today.

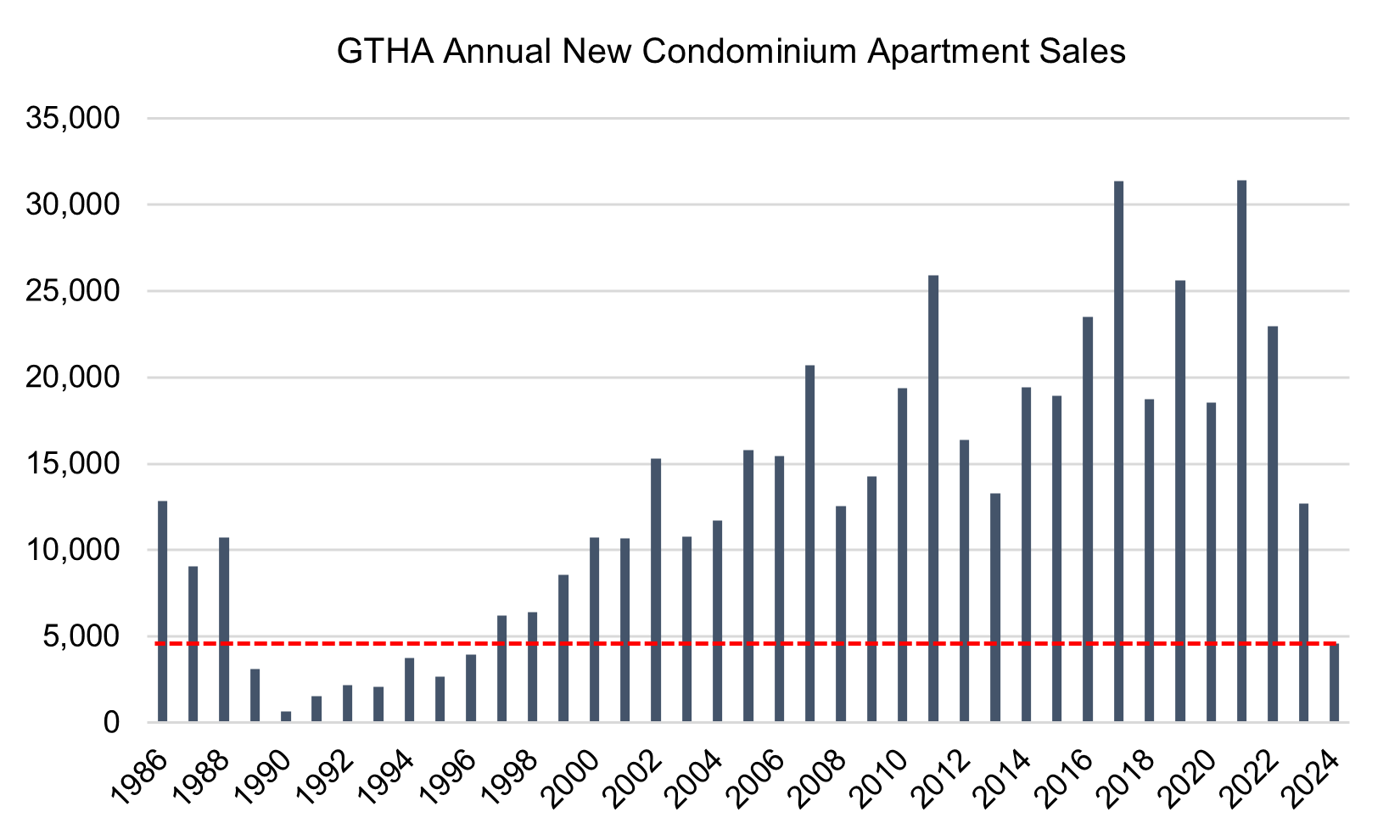

New condominium apartment sales totaled 802 units in Q4-2024, increasing 12% from Q3-2024 but down 71% annually and representing the lowest fourth quarter sales total since 1993.

Six projects totaling 1,829 units launched for presales during Q4-2024, of which only 10% of units sold. Over the past 10 years, an average of 6,123 new units launched during Q4 periods, achieving an average sales rate of 52%. Sales at new project launches were limited despite lower prices offered. New projects launched at an average price of $1,130 psf in Q4-2024, the lowest level since Q2-2021 and down 15% compared to new launches in Q4-2023 ($1,334 psf).

Unsold new condominium units in development (including pre-construction, under construction and recently completed projects) reached a record high 24,277 units at the end of 2024, increasing 6% from the previous year-end high in 2023 (22,978 units) and rising 50% above the latest 10-year average (16,154 units). At the 2024 level of sales, it would take 64 months to clear current unsold inventory, a record high that is nearly six times higher than a balanced level of inventory at 10-12 months of supply.

Overall, unsold new condominium apartment prices averaged $1,338 psf in Q4-2024, a 3% decrease from a year earlier ($1,375 psf) and a 5% decrease compared to two years ago in Q4-2022 ($1,407 psf).

A total of 10,916 new condominium apartments reached completion in Q4-2024, rising 71% compared to a year earlier. This brought total completions in 2024 to a record high of 29,800 units, 24% higher than the previous record set in 2023 (24,117 units) and 61% higher than the 10-year average (18,535 units). Completions are set for another record high in 2025 with 30,793 units scheduled to finish construction.

A total of 1,506 new condominium apartments started construction in Q4-2024, down 59% year-over-year. Total condominium starts in 2024 fell to their lowest level since 2002 at 9,258 units — a 51% drop from 2023 (18,950 units) and 56% below the 10-year average of 21,213 units. A total of 78,742 new condos were under construction in the GTHA as of Q4-2024, representing the lowest number of units being built in the region since Q2-2020.

“The new condo market just experienced its toughest year in three decades. Expectations for the market remain low this year as investors, the primary driver of presale activity, continue to deal with negative cash flow, difficulties arranging financing and declining prices and rents. The drop in presale activity will continue to cripple construction starts in 2025, causing a massive decrease in new supply beginning in 2026-2027.”

--Shaun Hildebrand, President of Urbanation

Latest Research

January 31, 2025

Ottawa Rental Vacancy Increases as New Completions Continue to GrowJanuary 28, 2025

GTHA Rental Vacancy Highest Since PandemicJanuary 16, 2025

GTHA New Condo Sales in 2024 Were Lowest Since 1996November 1, 2024

Ottawa Rental Construction Falls in Q3 Despite Low Vacancy and Rising RentsOctober 30, 2024

Record Condo Completions Bring Down Rents in TorontoOctober 18, 2024

GTHA New Condo Sales Fall to Nearly 30-Year Low in Q3-24

In The News

April 9, 2025

Average asking rents decrease for sixth straight month to $2,119: reportApril 8, 2025

National Average Rent Sees 6th Straight Annual Decline In MarchApril 1, 2025

Landlords are offering free months of rent, complimentary Wi-Fi and Presto cards to attract new tenantsMarch 27, 2025

Storeys: Ontario's Rental Supply Gap Projected To Surpass 200,000 In Next 10 YearsFebruary 6, 2025

BNN: National rent prices hit 18-month low in January: reportJanuary 29, 2025

Toronto Star: A wave of new rental buildings and condos led to lower prices, deals for Toronto-area tenants in 2024, report finds