TORONTO – January 28, 2025: Urbanation Inc., the leading source of data and analysis on the Greater Toronto Hamilton Area (GTHA) condominium and rental apartment markets since 1981, released its year-end 2024 rental market results today.

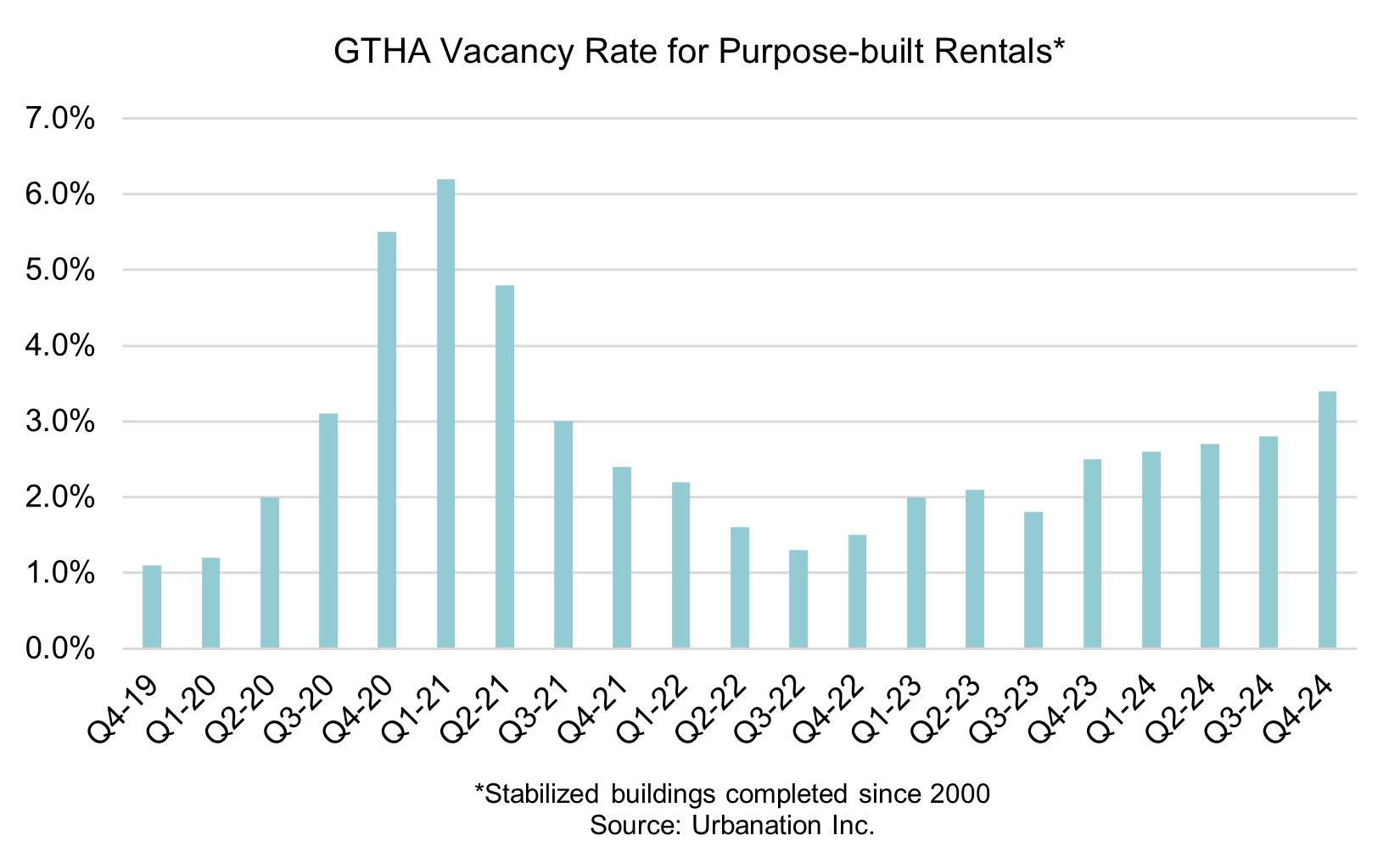

The vacancy rate for purpose-built rental buildings completed since 2000 in the GTHA was 3.4% in Q4-2024, increasing from 2.5% a year ago in Q4-2023 to reach its highest level since Q2-2021. Vacancy rates have risen due to high asking rents and increased supply competition among landlords.

Rents for new purpose-built rentals available to lease during Q4-2024 averaged $4.09 per square foot (psf), which was based on an average monthly rent of $2,967 and an average unit size of 726 square feet (sf). Rents edged up 0.6% from a year ago to reach their highest Q4 level on record, increasing by a total of 18.6% over the past five years.

Rents for one-bedroom apartments decreased 0.6% annually to $4.26 psf ($2,536 for 595 sf), while increasing 1.7% for two-bedrooms to $3.84 psf ($3,327 for 865 sf) and rising 4.8% for three-bedroom units to $4.11 psf ($4,425 for 1,077 sf).

Purpose-built rental completions totaled 5,537 units in 2024, decreasing 4% from the recent high in 2023 (5,779 units) but remaining 86% higher than the 10-year average of 2,977 units. Purpose-built rental completions are expected to reach a multi-decade high in 2025 with 8,872 units scheduled for delivery.

Rental supply pressures were strongest within the condominium market last year with a record high of 29,800 units completed, approximately half of which were listed for rent. While the total number of condo leases signed during 2024 grew 29% compared to 2023 to a record-high, active condo rental listings at year-end rose 72% annually to 5,646 units, a record-high outside of the pandemic.

As a result, average condo rents decreased year-over-year for the third straight quarter, down 1.8% annually to a seven-quarter low of $3.89 psf in Q4-2024. Average monthly condo rents experienced a larger annual decline of 4.7% to a 10-quarter low of $2,682 in Q4-2024. This occurred as an influx of small units reduced the average size of condo rentals from 710 sf in Q4-2023 to 690 sf in Q4-2024.

The smallest condos experienced the largest annual decreases in rents. Micro units less than 400 sf saw average rents drop 9.0% over the past year, with 400-499 sf units recording a 6.0% annual decrease and 500-599 sf units seeing a 4.8% annual decrease. Rents for the largest units 1,000 sf and over held steady compared to last year.

The softening rental market conditions and challenging cost environment for development caused purpose-built rental construction starts to decline 10% in 2024 to 5,960 units. In the City of Toronto, purpose-built rental starts dropped 35% between 2023 and 2024 to 3,534 units.

Shaun Hildebrand, President of Urbanation

Latest Research

April 15, 2025

Slowest Condo Market in Over 30 Years Causing Construction to CollapseJanuary 31, 2025

Ottawa Rental Vacancy Increases as New Completions Continue to GrowJanuary 28, 2025

GTHA Rental Vacancy Highest Since PandemicJanuary 16, 2025

GTHA New Condo Sales in 2024 Were Lowest Since 1996November 1, 2024

Ottawa Rental Construction Falls in Q3 Despite Low Vacancy and Rising RentsOctober 30, 2024

Record Condo Completions Bring Down Rents in Toronto

In The News

April 23, 2025

Canadians turn against condos as a 'good' investment as sector goes through 'rough period'April 23, 2025

Condos in Toronto region headed for a crunch as fewer start constructionApril 22, 2025

Hundreds of planned condo units cancelled: ‘Market cratered almost overnight”April 16, 2025

GTHA Sees Slowest New Condo Sales In Over 30 Years, Construction 'Collapses'April 15, 2025

Toronto and Hamilton-area new condo market sees the slowest quarter in 30 years, says new reportApril 9, 2025

Average asking rents decrease for sixth straight month to $2,119: report