TORONTO – July 30, 2024: Urbanation Inc., the leading source of data and analysis on the Greater Toronto Hamilton Area (GTHA) condominium and rental apartment markets since 1981, released its Q2-2024 rental market results today.

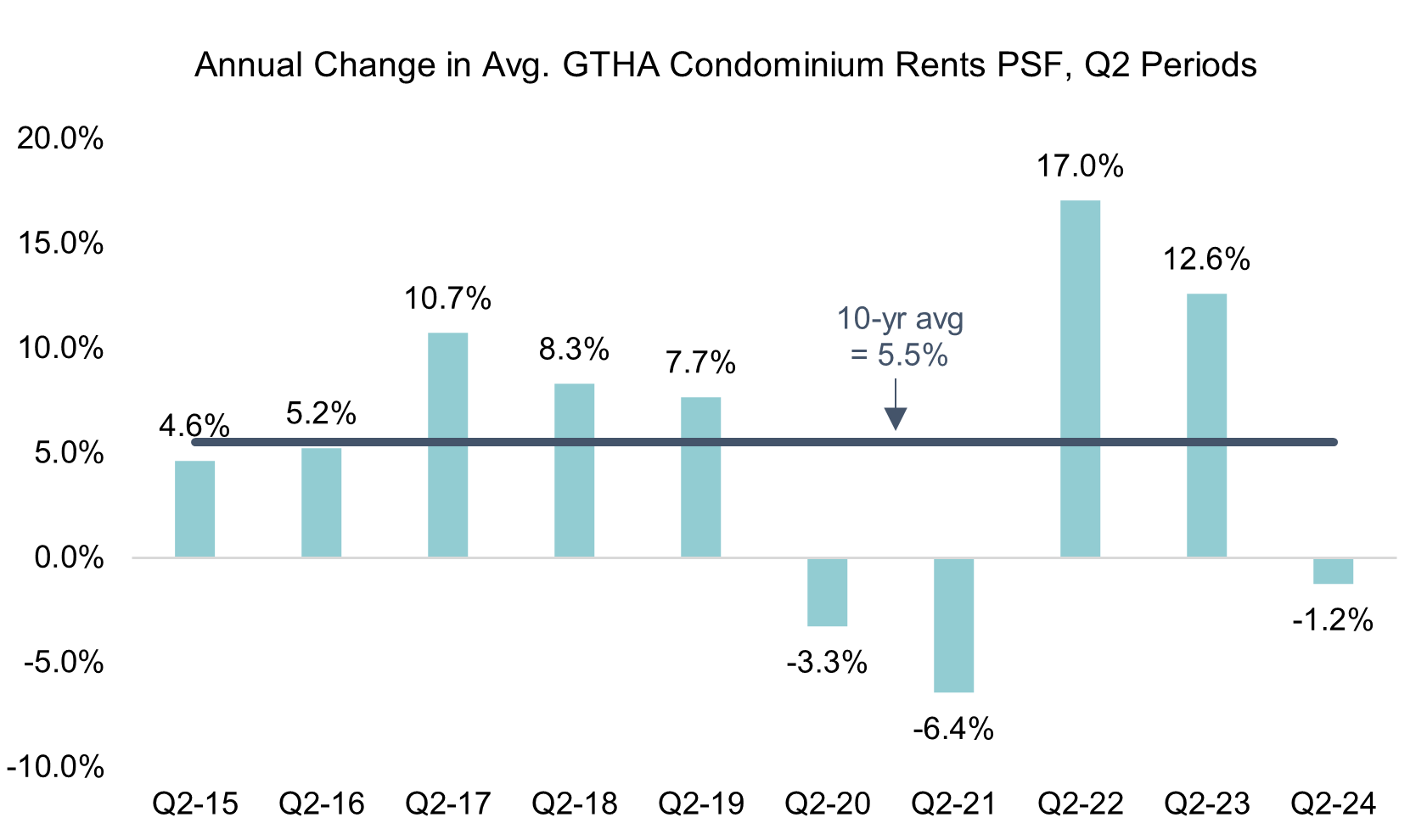

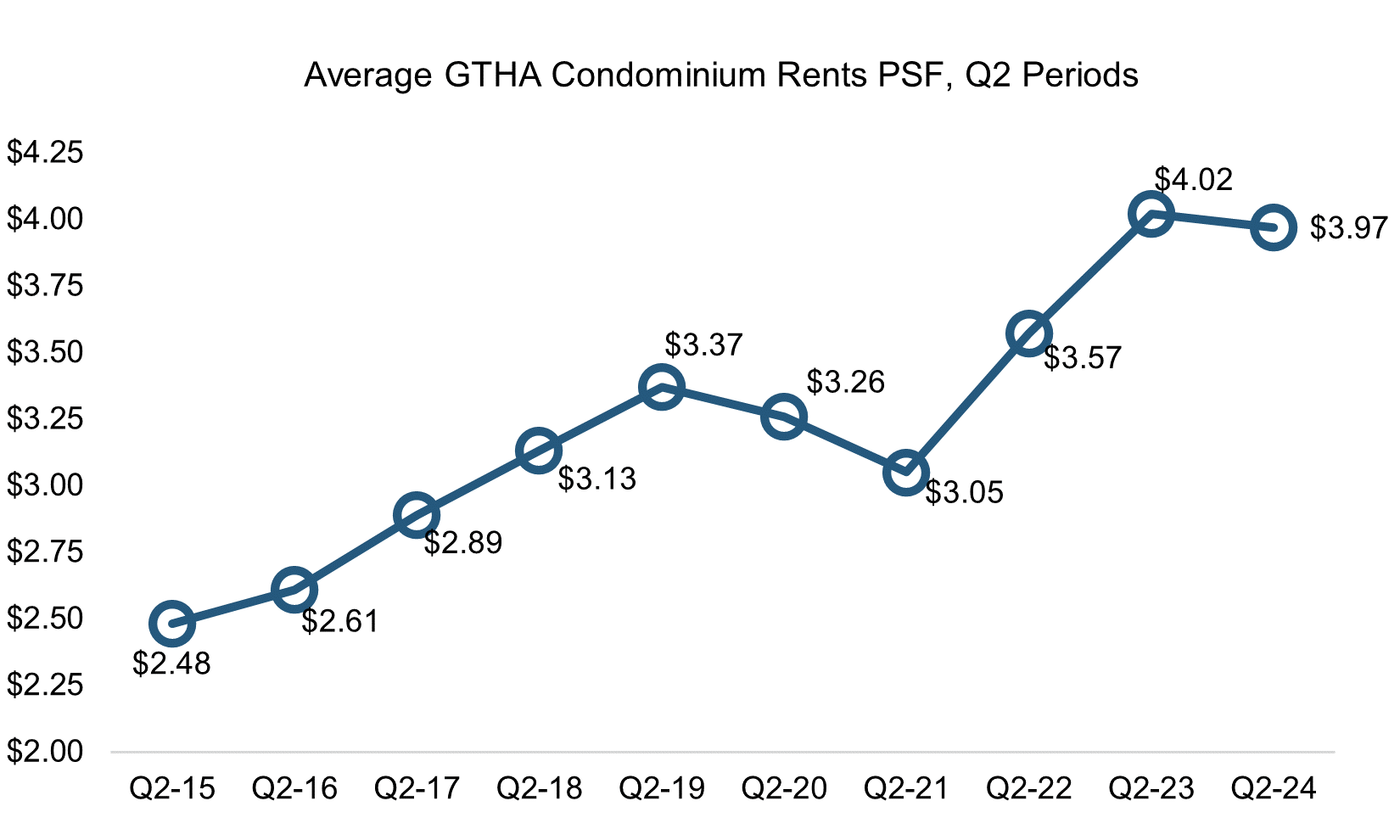

Average condo rents for leases signed during the second quarter in the GTHA decreased 1.2% year-over-year to $3.97 per square foot ($2,723 for 686 sf), representing the first annual decline since Q2-2021 when the market was impacted by COVID-19.

Studios experienced the largest annual decline in rents, decreasing 3.9% to an average of $5.18 psf ($2,047 for 395 sf). One-bedroom rents declined 1.8% from a year ago to an average of $4.14 psf ($2,450 for 591 sf), while two-bedroom rents were down 0.9% annually to an average of $3.54 psf ($3,143 for 889 sf). Three-bedroom rents held up the best, decreasing 0.6% from a year ago to an average of $3.83 psf ($3,988 for 1,041 sf).

Regionally, rents in the City of Toronto declined 2.1% annually to an average of $4.10 psf ($2,765 for 674 sf), while rents in the 905 region of the GTHA increased 2.0% annually to an average of $3.63 psf ($2,610 for 719 sf).

The overall decline in condo rents occurred despite strong demand during the quarter. The number of condo lease transactions in the GTHA reached a record high of 16,169 units in Q2, increasing 29% annually and rising 60% above the 10-year average. At the same time, however, the total number of condos listed for rent during Q2 increased 47% year-over-year to 21,695 units. Listings surged last quarter as the number of newly registered condos increased 82% from a year ago to 8,380 units.

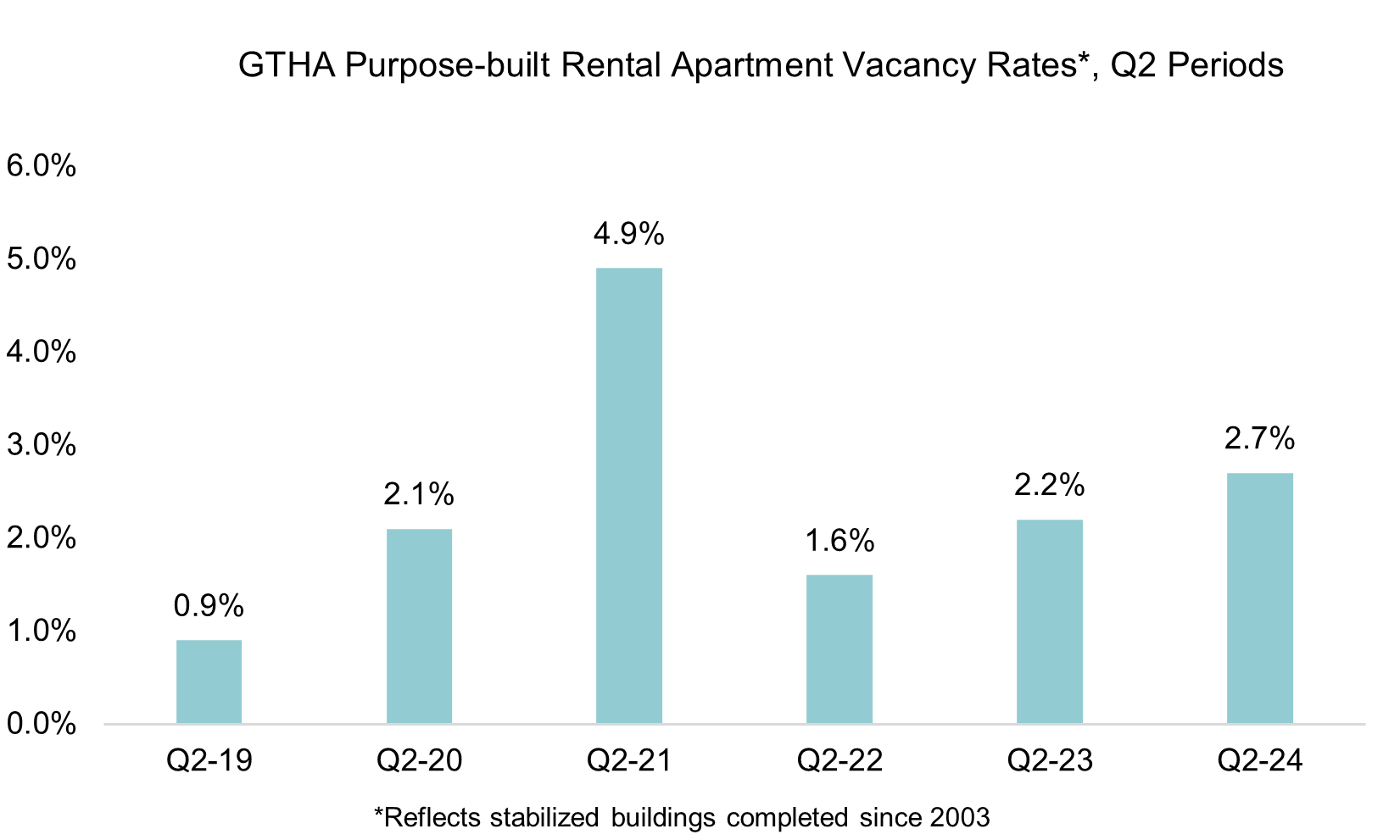

For purpose-built rentals completed in the GTHA since 2000, vacancy rates moved up to an 11-quarter high of 2.7% in Q2-2024, edging up from 2.6% in Q1-2024 and 2.2% a year ago in Q2-2023. The vacancy rate reached 2.8% in the City of Toronto and 2.6% in the 905 region of the GTHA.

As vacancy rates gradually moved higher, rent growth for GTHA purpose-built rentals completed since 2000 slowed to a 2.2% annual pace in Q2-2024, with rents reaching an average of $4.08 psf ($2,953 for 723 sf). Average purpose-built rents in the City of Toronto decreased 0.5% annually to $4.46 psf ($3,104 for 696 sf), while average purpose-built rents in the 905 region of the GTHA increased 7.7% annually to $3.39 psf ($2,639 for 778 sf).

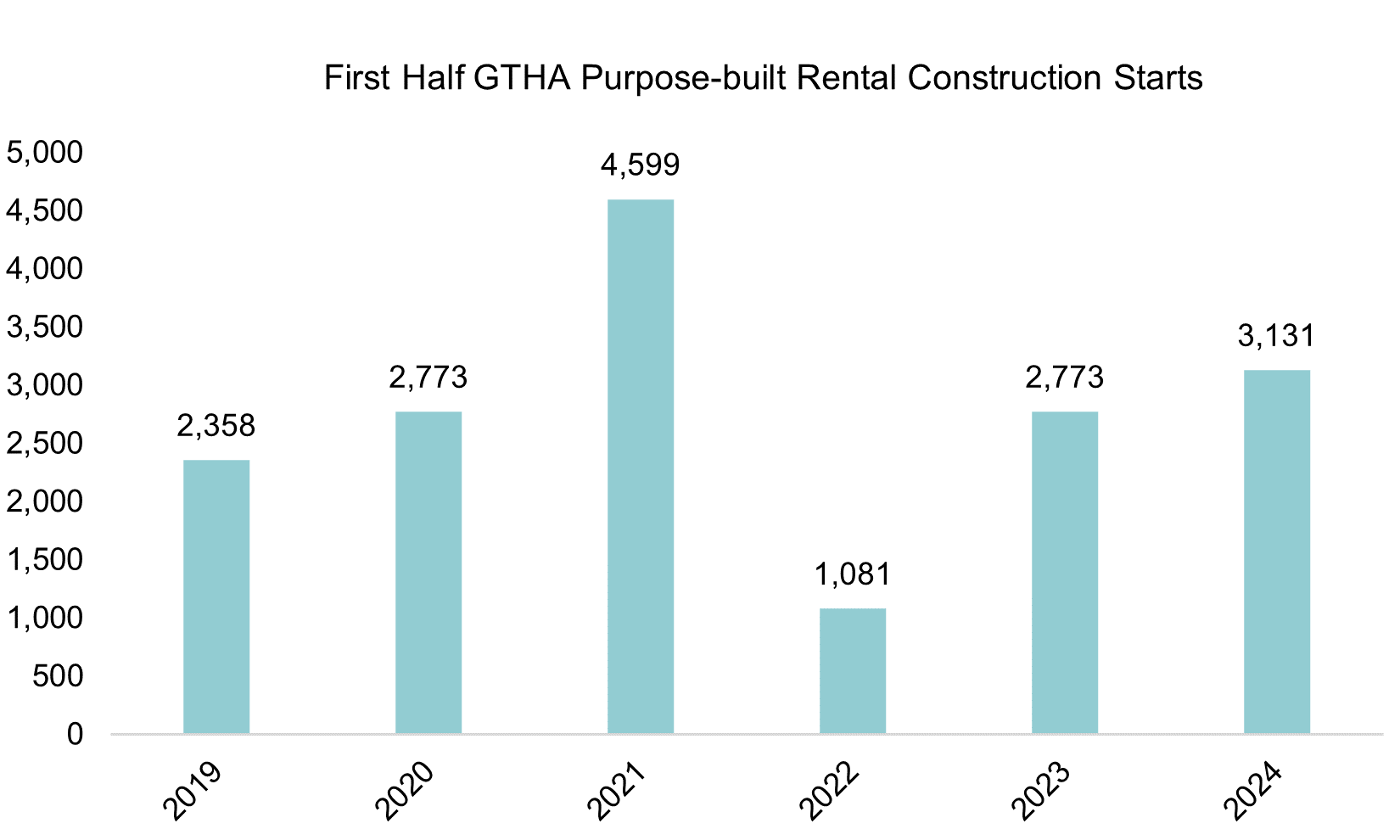

A total of 1,558 purpose-built rentals began construction in Q2, rising 43% from a year ago. Construction starts totaling 3,131 units in the first half of 2024 rose 13% annually and were up 190% from the low during the first half of 2022, but remained 32% below first half starts in 2021.

As of Q2-2024, there were 23,376 purpose-built rentals under construction in the GTHA. Additionally, there were 159,176 purpose-built rentals proposed for development across the region that had not yet started construction, of which 67,431 units were approved.

“Rents are experiencing some softening mainly due to a temporary spike in condo completions, which will subside following the steep drop off in new condo sales and construction activity. While some recent improvement to rental construction has been occurring, the level of starts for rentals remains much too low to keep pace with demand over the longer-term.”

Shaun Hildebrand, President of Urbanation

Latest Research

November 4, 2025

Ottawa Rental Starts Reach Multi-Decade High in Q3October 28, 2025

GTHA Rental Projects Forge Ahead in Q3 Despite Declining RentsOctober 16, 2025

Condo Project Cancellations Hit Record High in Q3 as Sales Fall to 35-Year LowSeptember 11, 2025

The housing market – where are we?August 20, 2025

GTA Rental Supply Gap to Double in Next 10 YearsAugust 14, 2025

Ottawa Rental Supply Spikes in Q2

In The News

November 26, 2025

Fewer Canadians think condos are a good investment, offering a silver lining for younger homebuyersNovember 5, 2025

How presales helped Canada’s condo market boom, then collapseOctober 29, 2025

Rental construction is at a 50-year high in Toronto and Hamilton area, as more than 27,000 units converted from condosOctober 17, 2025

Condo sales in Toronto, Hamilton fall to 35-year low in third quarterOctober 17, 2025

Toronto and Hamilton-area condo cancellations have hit a record high. Here’s how many have been cancelled this yearOctober 15, 2025

Developers of GTHA purpose-built rentals find it’s taking longer than ever to fill empty buildings