TORONTO – July 18, 2024: Urbanation Inc., the leading source of information and analysis on the condominium market since 1981, released its Q2-2024 Condominium Market Survey results today.

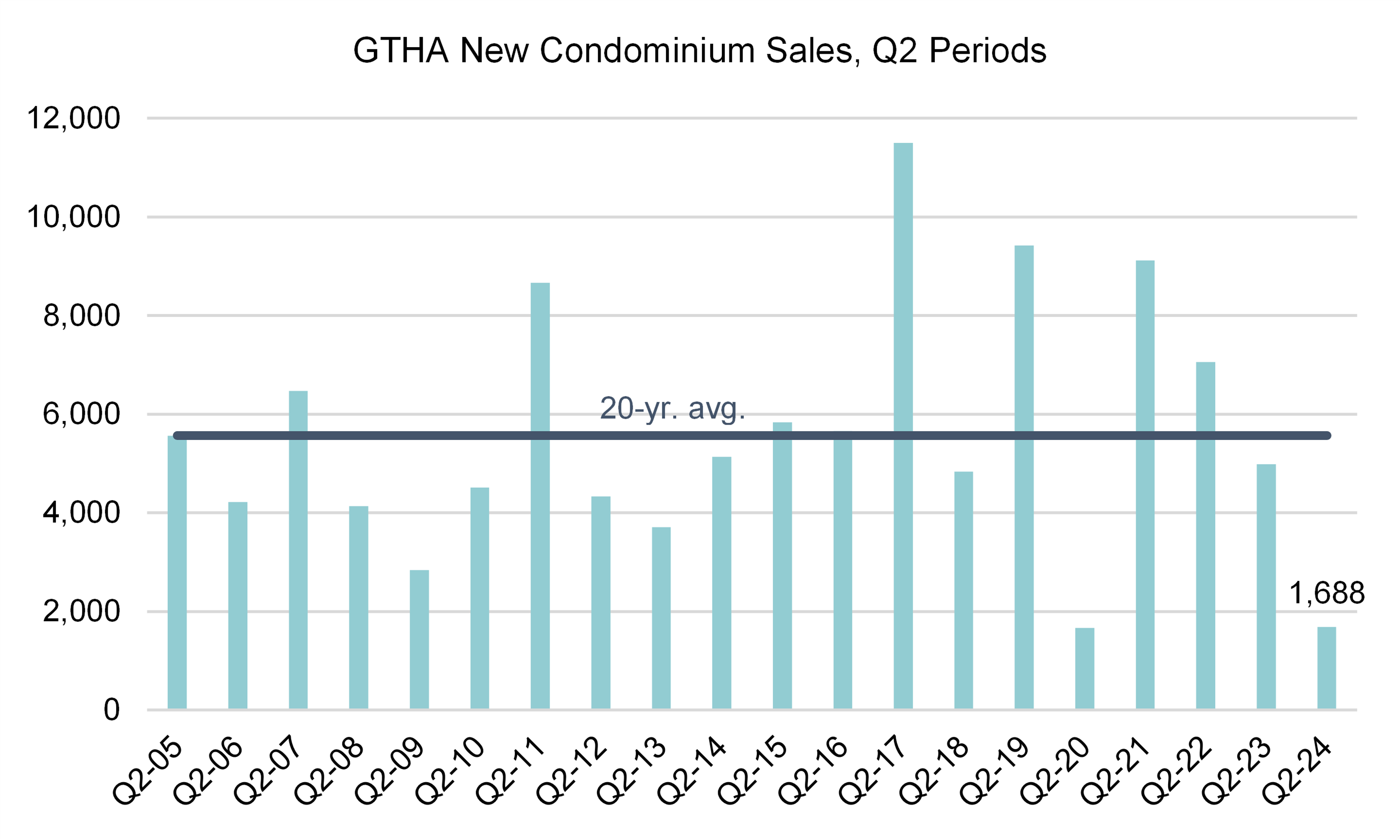

The Greater Toronto Hamilton Area (GTHA) new condominium market reported 1,688 sales in Q2-2024, down 66% year-over-year and falling 70% below the 20-year average. Last quarter’s sales represented the lowest Q2 result of the past 20 years outside of the initial months of COVID-19 in Q2-2020 (1,671 sales).

New condo sales in the first half of 2024 totaled just 3,159 units, a 57% decline from a year ago and 72% below the 10-year average. It was the slowest first half for new condo sales since 1997.

Of the 3,625 units that launched for presale in Q2-2024, only 17% were sold — an opening quarter absorption rate not seen in over 25 years and less than half of the decade average of 56%.

The drop in sales during the second quarter caused total unsold inventory to climb to a record high 25,893 units, a level that was approximately 10,000 units (more than 60%) higher than both the 10-year and 20-year averages. When measured against sales over the past 12 months, unsold inventory equalled 34 months of supply — roughly three times higher than a balanced level of 10-12 months. In the past year alone, months of supply nearly doubled. Most unsold inventory was in pre-construction projects with a total of 15,157 units, compared to 9,788 unsold units under construction, and 948 unsold units in recently completed buildings.

Overall, there has been minor movement in asking prices for unsold units despite the sharp drop in sales and rise in inventory. Average asking prices for unsold units declined 2.6% over the past year and by a total of 4.5% over the past two years to an average of $1,361 psf. This demonstrates how sticky new condominium prices have become due to high development and financing costs, and record prices paid for land at the market peak.

The industry remained focused on closing out new projects, with the latest four-quarter total for completions reaching 28,163 units in Q2-2024, edging down only slightly from the record high during the four-quarter period ending Q1-2024 (28,977 units). However, completions are expected to continue trending down for the remainder of the year. The 4,788 units that were completed in Q2-2024 was a six-quarter low, with completions scheduled for the second half of 2024 totaling 10,205 units — a 38% decline from the first half total of 16,455 completions.

The run-up in completions has coincided with a sharp downturn in construction starts, which is directly tied to the slowdown in new condo sales. Only 727 new condo units started construction in Q2-2024, a more than 20-year low that brought the latest four-quarter total down to 9,182 units — a 67% plunge from the 28,026 units that started construction during the annual period ending a year ago in Q2-2023. The combination of high completions and low starts caused the inventory of total condos under construction in the GTHA to fall to a more than three-year low of 87,508 units, a decline of nearly 19,000 units over the past year.

Latest Research

April 15, 2025

Slowest Condo Market in Over 30 Years Causing Construction to CollapseJanuary 31, 2025

Ottawa Rental Vacancy Increases as New Completions Continue to GrowJanuary 28, 2025

GTHA Rental Vacancy Highest Since PandemicJanuary 16, 2025

GTHA New Condo Sales in 2024 Were Lowest Since 1996November 1, 2024

Ottawa Rental Construction Falls in Q3 Despite Low Vacancy and Rising RentsOctober 30, 2024

Record Condo Completions Bring Down Rents in Toronto

In The News

April 16, 2025

GTHA Sees Slowest New Condo Sales In Over 30 Years, Construction 'Collapses'April 15, 2025

Toronto and Hamilton-area new condo market sees the slowest quarter in 30 years, says new reportApril 9, 2025

Average asking rents decrease for sixth straight month to $2,119: reportApril 8, 2025

National Average Rent Sees 6th Straight Annual Decline In MarchApril 1, 2025

Landlords are offering free months of rent, complimentary Wi-Fi and Presto cards to attract new tenantsMarch 27, 2025

Storeys: Ontario's Rental Supply Gap Projected To Surpass 200,000 In Next 10 Years